CVS Stock Information :

Table of Contents

1. Introduction CVS Stocks

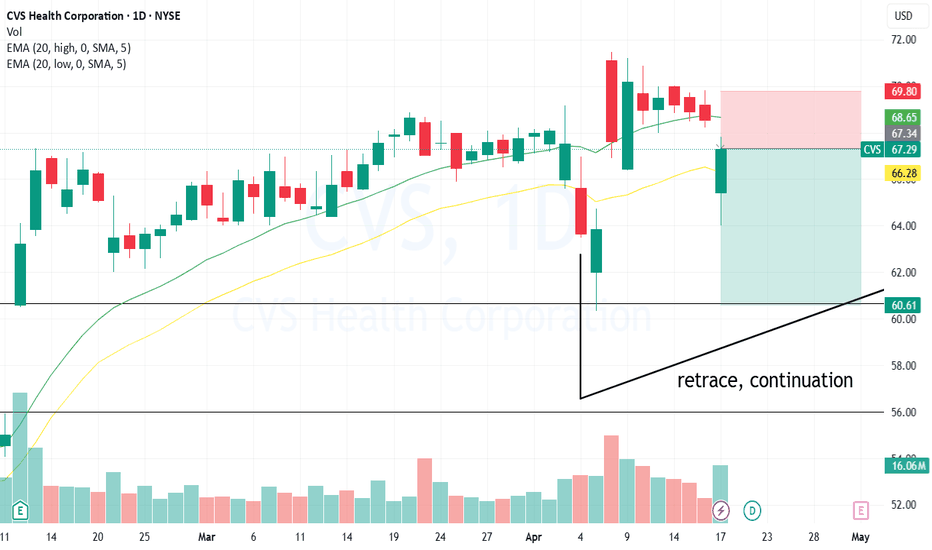

CVS Health Corporation (NYSE: CVS) is a prominent American healthcare company, encompassing a vast network of pharmacies, health insurance services, and healthcare clinics. As of May 1, 2025, CVS’s stock price stands at $66.71, reflecting a 2.55% increase from the previous close. The company has recently demonstrated a robust financial turnaround, prompting analysts to reassess its growth trajectory

2. CVS Stock Company Overview

As a result, CVS raised its full-year adjusted EPS forecast to $6.00–$6.20, up from the previous estimate of $5.75–$6.00. The company’s shares surged 8.5% following the announcement.

Founded in 1963 in Lowell, Massachusetts, CVS Health has evolved into one of the world’s largest healthcare companies. Its diverse portfolio includes:Wikipedia

- CVS Pharmacy: A leading retail pharmacy chain with over 9,000 locations across the U.S.

- Aetna: A major health insurance provider serving millions of members.

- CVS Caremark: A pharmacy benefit manager offering comprehensive prescription services.

- MinuteClinic: Retail medical clinics providing walk-in healthcare services.Wikipedia

Under the leadership of CEO David Joyner, who assumed the role in October 2024, CVS has embarked on a strategic restructuring to enhance operational efficiency and focus on high-growth areas.

3. 📈 How’s the CVS Stock Doing?

As of May 1, 2025, CVS stock is around $66.71, up more than 2.5% in a day. Why? Because they recently beat Wall Street’s expectations:

- Quarterly earnings were $2.25 per share, way above the expected $1.70.

- Revenue grew to over $94 billion for the quarter.

- They also raised their forecast for the year, which investors love.

Also, under new CEO David Joyner, they’re cutting costs, reshuffling leadership, and focusing more on high-growth areas. That gave investors more confidence in the stock.

3. Financial Performance of CVS Stock

In the first quarter of 2025, CVS reported adjusted earnings per share (EPS) of $2.25, surpassing analyst expectations of $1.70.

- Revenue Growth: Total revenue increased by 7% year-over-year to $94.59 billion.

- Segment Performance: The pharmacy and health services units exceeded revenue forecasts, with $31.91 billion and $43.46 billion, respectively.

- Operational Efficiency: A reduction in the medical loss ratio to 87.3% from 90.4% a year ago indicated improved cost management.

As a result, CVS raised its full-year adjusted EPS forecast to $6.00–$6.20, up from the previous estimate of $5.75–$6.00. The company’s shares surged 8.5% following the announcement.

🔍 What’s CVS Planning for the Future?

CVS is making some bold moves:

- Leaving Obamacare’s exchange by 2026 via Aetna to focus on more profitable business lines.

- Partnering with Novo Nordisk to push Wegovy (a weight-loss drug) as a preferred treatment in its pharmacy network.

- Cutting some expenses and reorganizing leadership to make the business run more smoothly.

They’re clearly trying to move away from just being a pharmacy chain and become a full-scale healthcare company.

4. Strategic Initiatives of CVS

CVS is implementing several strategic initiatives to strengthen its market position:

Cost-Cutting Measures: Under CEO David Joyner’s leadership, CVS has implemented cost-cutting measures and a leadership reshuffle to aid recovery.

Exit from Individual Exchange Business: CVS announced plans to exit the Obamacare individual-healthcare exchange business through its Aetna unit by 2026, focusing on more profitable ventures.

Partnership with Novo Nordisk: CVS Caremark will make Novo Nordisk’s weight-loss medication, Wegovy, its preferred treatment starting July 1, 2025, enhancing access to effective therapies.

Q1: What factors contributed to CVS’s recent stock surge?

A combination of strong financial results, strategic initiatives, and improved operational efficiency has positively impacted investor sentiment.

Q2: How does CVS’s dividend yield compare to industry standards?

CVS offers a dividend yield of 4.05%, which is competitive within the healthcare sector.

Q3: What are the risks associated with investing in CVS stock?

Potential risks include regulatory changes, competitive pressures, and the company’s ability to execute its strategic initiatives effectively.

6. Conclusion

CVS Health Corporation is undergoing a significant transformation, focusing on high-growth areas and enhancing operational efficiency. With a strong financial performance and strategic initiatives in place, CVS is well-positioned for sustained growth. Investors should consider the company’s long-term prospects and the potential risks associated with its strategic decisions.

No responses yet